What Does Hsmb Advisory Llc Do?

What Does Hsmb Advisory Llc Do?

Blog Article

Rumored Buzz on Hsmb Advisory Llc

Table of ContentsNot known Factual Statements About Hsmb Advisory Llc Not known Facts About Hsmb Advisory LlcNot known Facts About Hsmb Advisory LlcHsmb Advisory Llc for DummiesEverything about Hsmb Advisory LlcOur Hsmb Advisory Llc PDFs

Ford claims to stay away from "money value or irreversible" life insurance policy, which is more of an investment than an insurance coverage. "Those are very complicated, featured high commissions, and 9 out of 10 people do not need them. They're oversold since insurance coverage representatives make the biggest payments on these," he says.

Impairment insurance policy can be expensive. And for those that decide for long-lasting treatment insurance, this policy might make handicap insurance policy unneeded.

How Hsmb Advisory Llc can Save You Time, Stress, and Money.

If you have a chronic wellness worry, this sort of insurance coverage might finish up being critical (Insurance Advise). However, do not let it emphasize you or your savings account early in lifeit's normally best to secure a policy in your 50s or 60s with the expectancy that you won't be using it till your 70s or later.

If you're a small-business owner, think about securing your income by buying service insurance coverage. In the occasion of a disaster-related closure or period of restoring, organization insurance can cover your income loss. Take into consideration if a substantial weather condition occasion affected your store or manufacturing facilityhow would certainly that influence your earnings? And for how much time? According to a report by FEMA, in between 4060% of small companies never ever reopen their doors adhering to a catastrophe.

And also, using insurance policy might sometimes set you back more than it saves in the future. If you obtain a chip in your windshield, you may take into consideration covering the repair service expenditure with your emergency situation cost savings instead of your car insurance policy. Why? Because utilizing your auto insurance can trigger your monthly premium to rise.

Hsmb Advisory Llc Fundamentals Explained

Share these suggestions to secure loved ones from being both underinsured and overinsuredand seek advice from with a trusted expert when needed. (https://hsmbadvisory.bandcamp.com/album/hsmb-advisory-llc)

Insurance that is acquired by a specific for single-person protection or protection of a family members. The specific pays the premium, rather than employer-based medical insurance where the company typically pays a share of the premium. People might look for and acquisition insurance policy from any internet type of plans available in the individual's geographic region.

People and families might qualify for financial support to decrease the price of insurance coverage premiums and out-of-pocket costs, however only when enrolling through Attach for Health Colorado. If you experience certain adjustments in your life,, you are qualified for a 60-day period of time where you can enroll in a private plan, also if it is outside of the annual open registration period of Nov.

15.

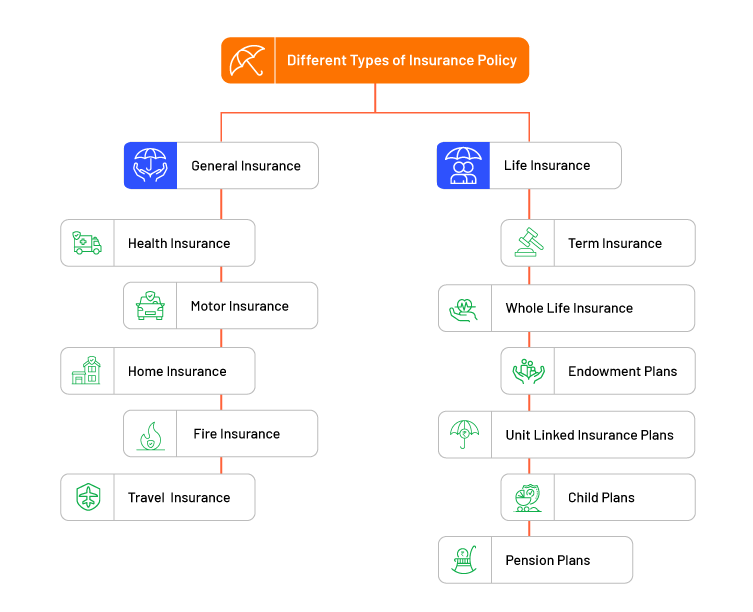

It may seem basic however comprehending insurance kinds can additionally be puzzling. Much of this confusion originates from the insurance policy market's recurring goal to create individualized coverage for insurance policy holders. In creating flexible policies, there are a variety to pick fromand every one of those insurance coverage types can make it tough to comprehend what a certain plan is and does.

5 Easy Facts About Hsmb Advisory Llc Explained

If you pass away during this period, the individual or people you have actually called as beneficiaries might obtain the cash payment of the plan.

Nevertheless, numerous term life insurance policy policies allow you transform them to an entire life insurance policy policy, so you do not lose insurance coverage. Typically, term life insurance policy policy costs payments (what you pay monthly or year right into your policy) are not secured at the time of purchase, so every 5 or 10 years you possess the plan, your costs can climb.

They likewise tend to be less expensive overall than whole life, unless you get a whole life insurance plan when you're young. There are also a couple of variants on term life insurance. One, called team term life insurance policy, prevails among insurance alternatives you may have accessibility to with your company.

The Facts About Hsmb Advisory Llc Revealed

One more variation that you may have access to with your company is extra life insurance coverage., or interment insuranceadditional protection that could assist your household in situation something unforeseen occurs to you.

Permanent life insurance merely refers to any type of life insurance coverage policy that does not end.

Report this page